The role of a CPA involves managing financial records, ensuring compliance with regulations, and providing strategic tax planning for clients. When crafting your resume, focus on your experience with financial reporting, tax preparation, and auditing processes. Highlight abilities in data analysis, attention to detail, and proficiency with accounting software. To demonstrate your worth, emphasize your contributions to cost savings and successful financial audits that improved client outcomes.

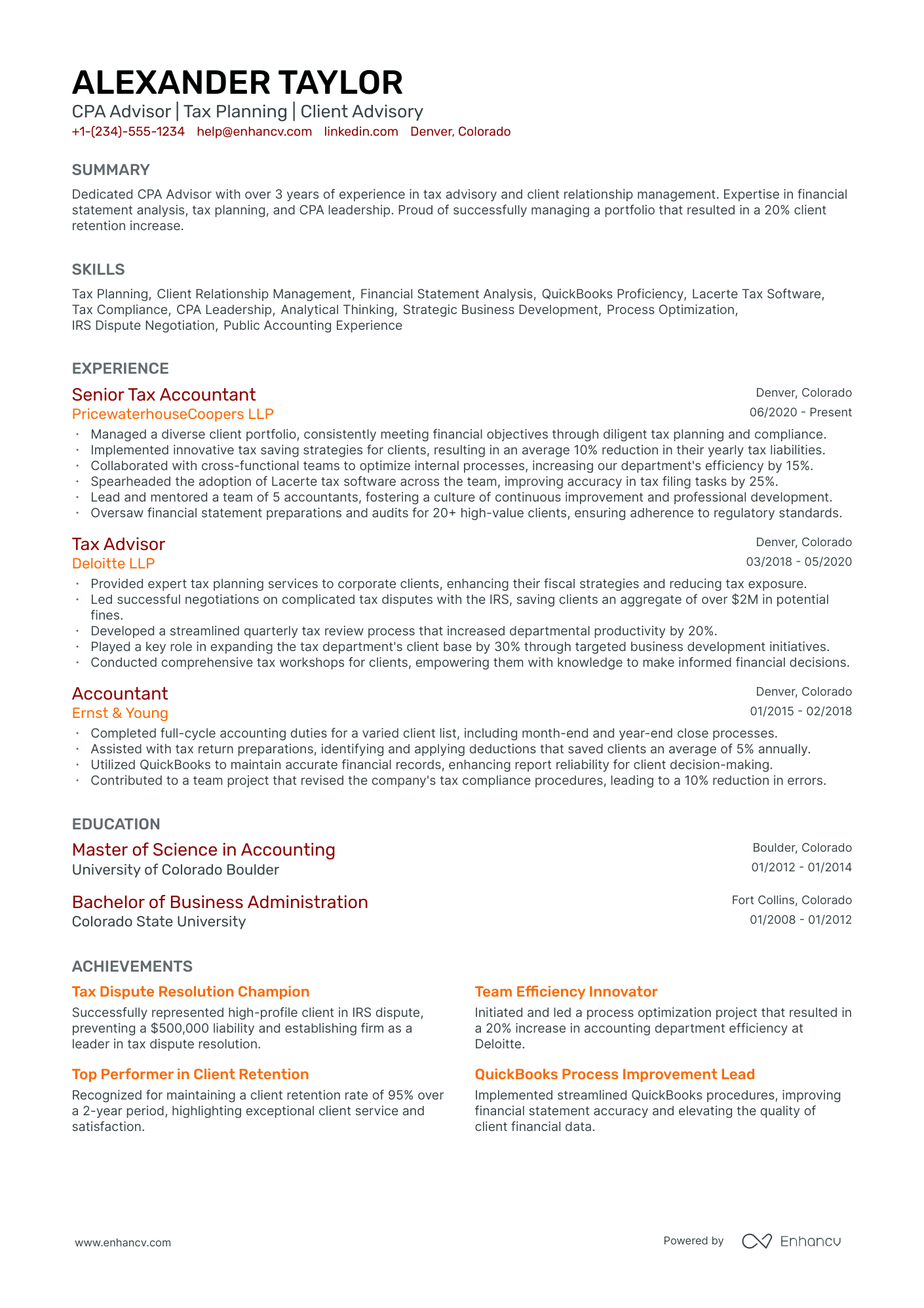

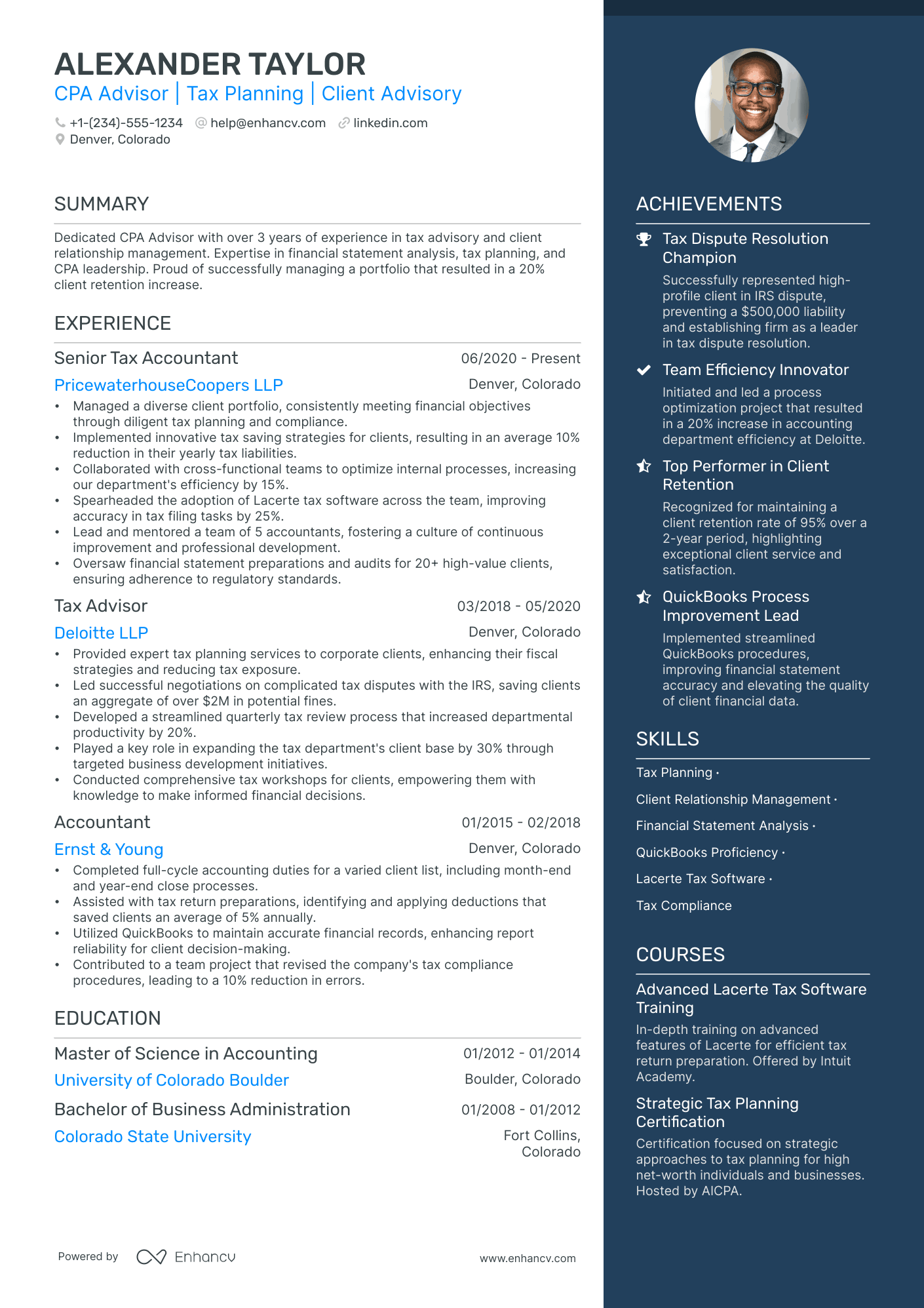

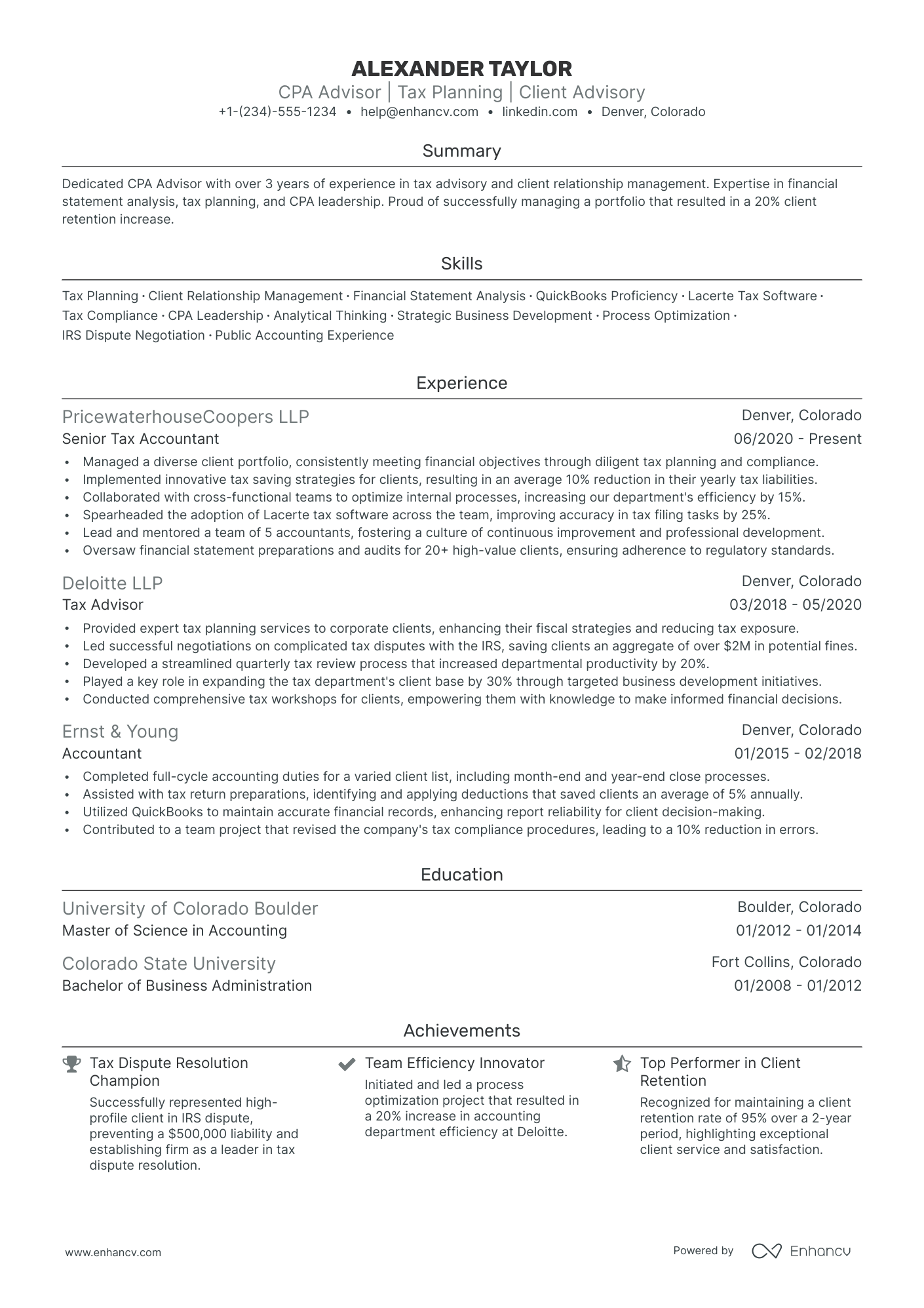

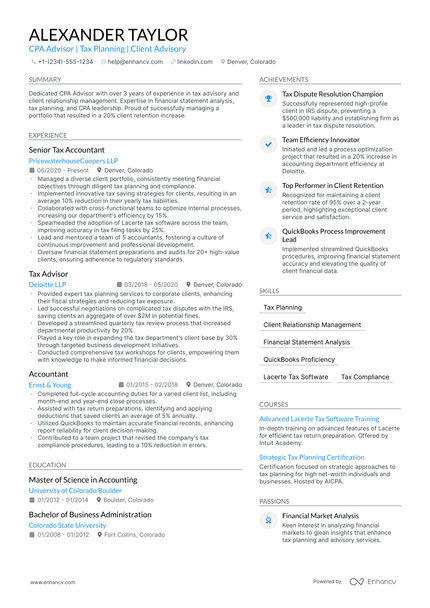

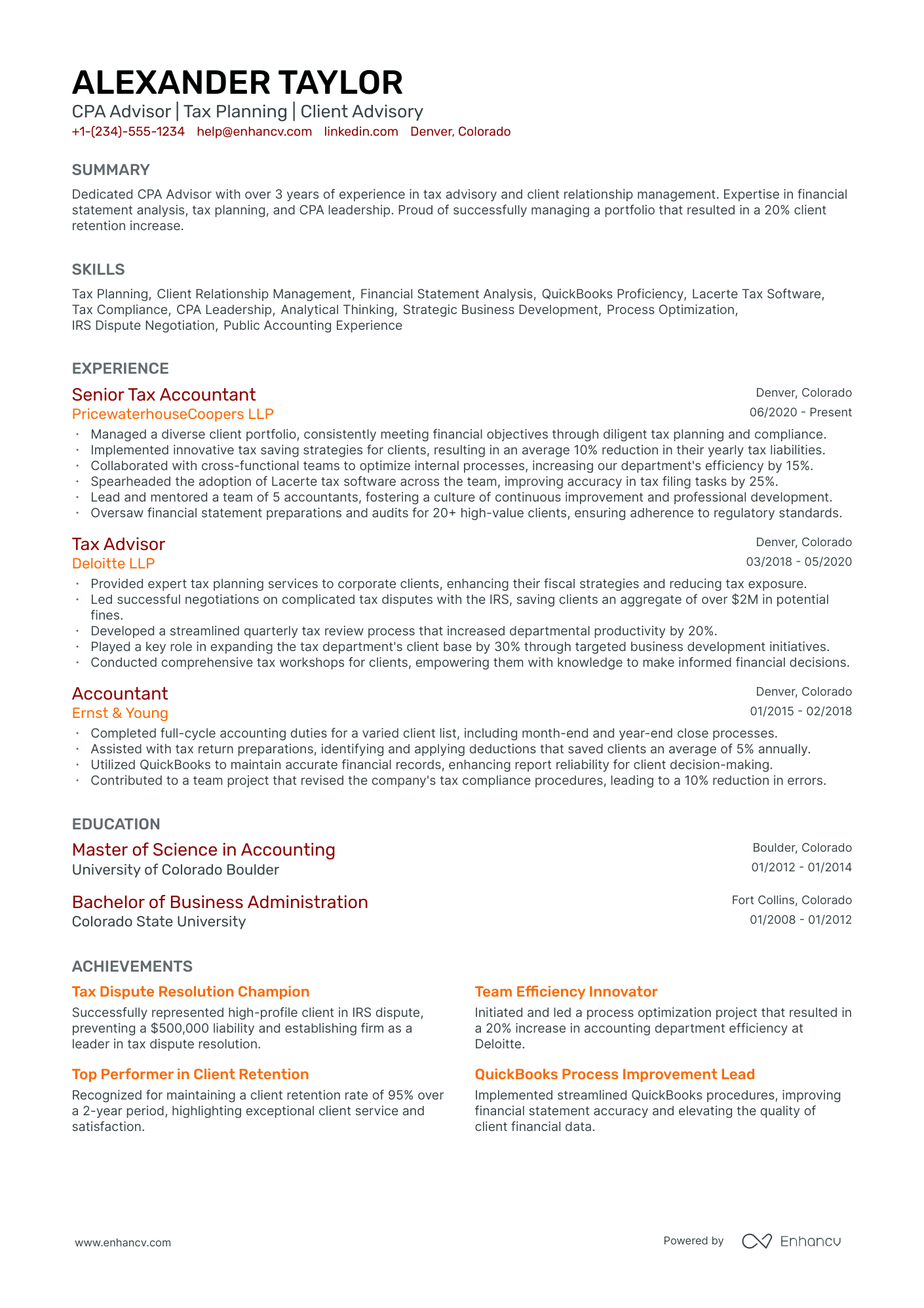

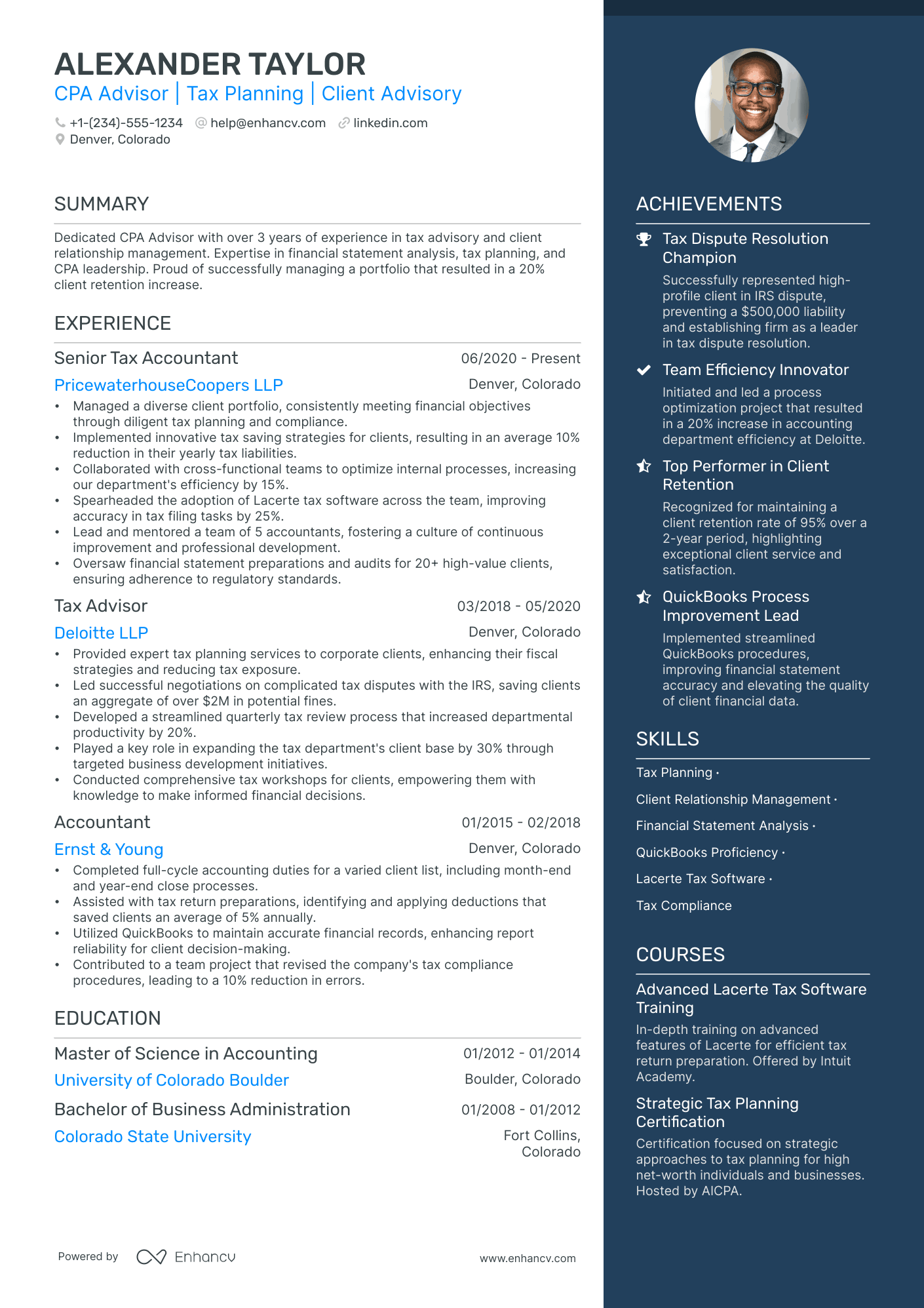

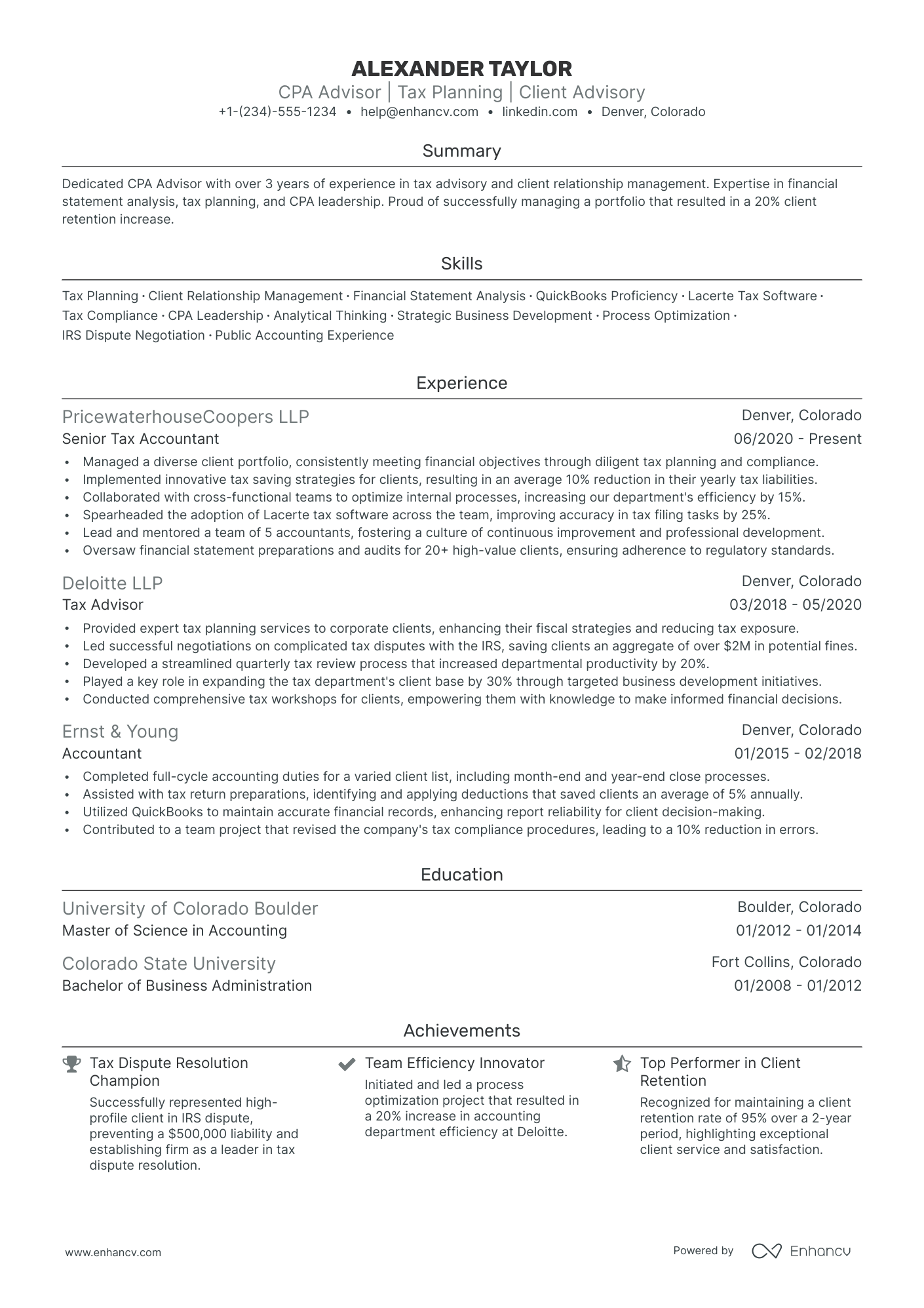

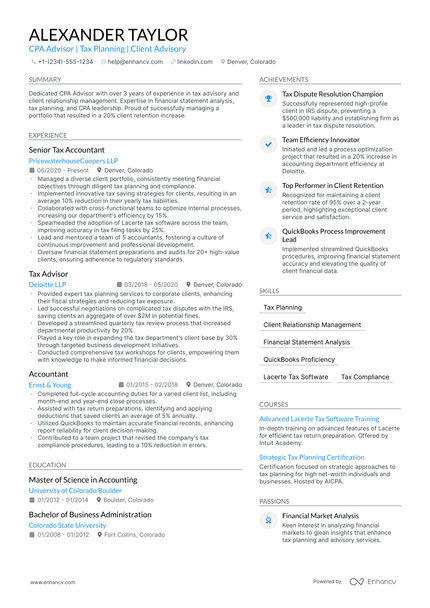

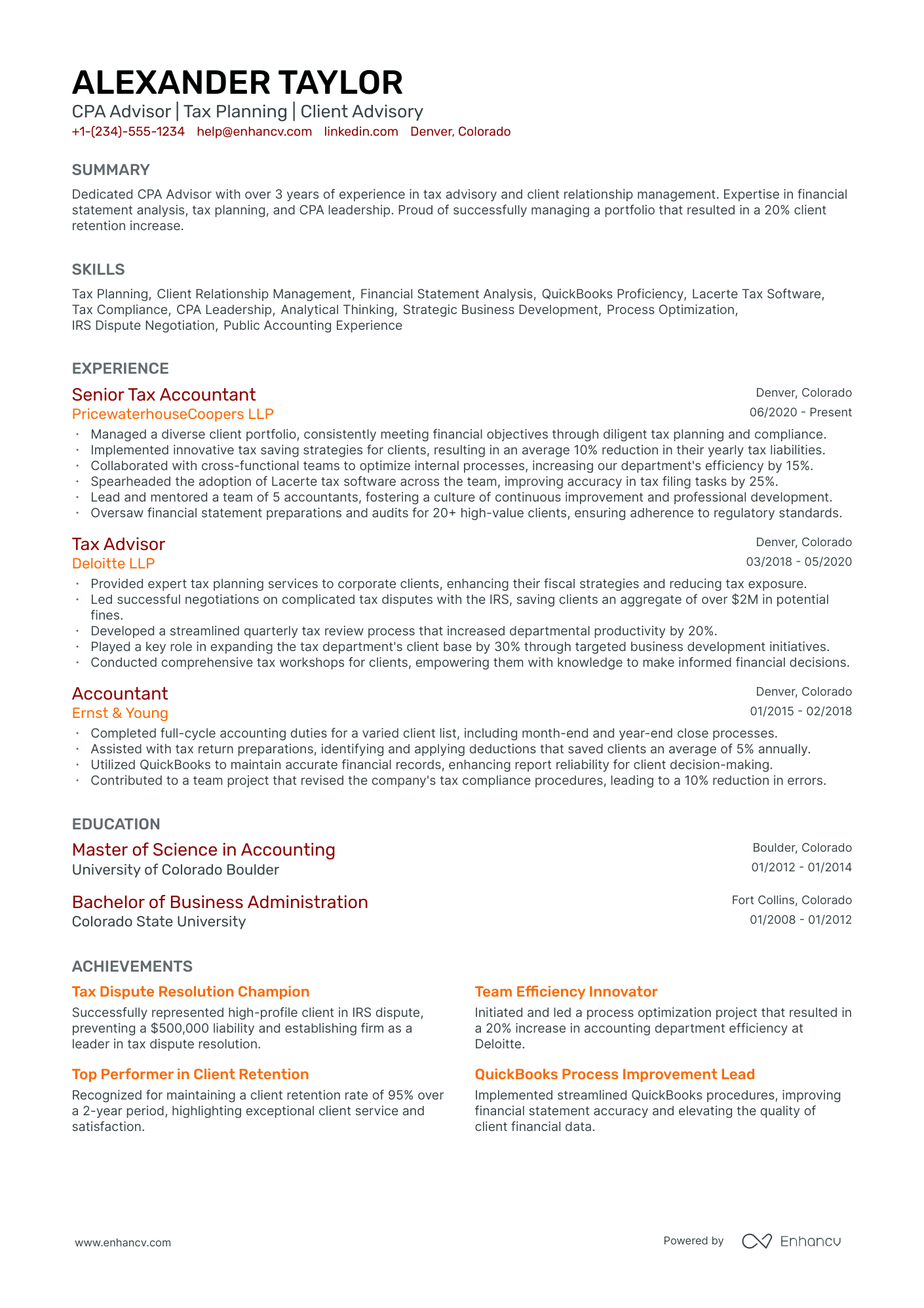

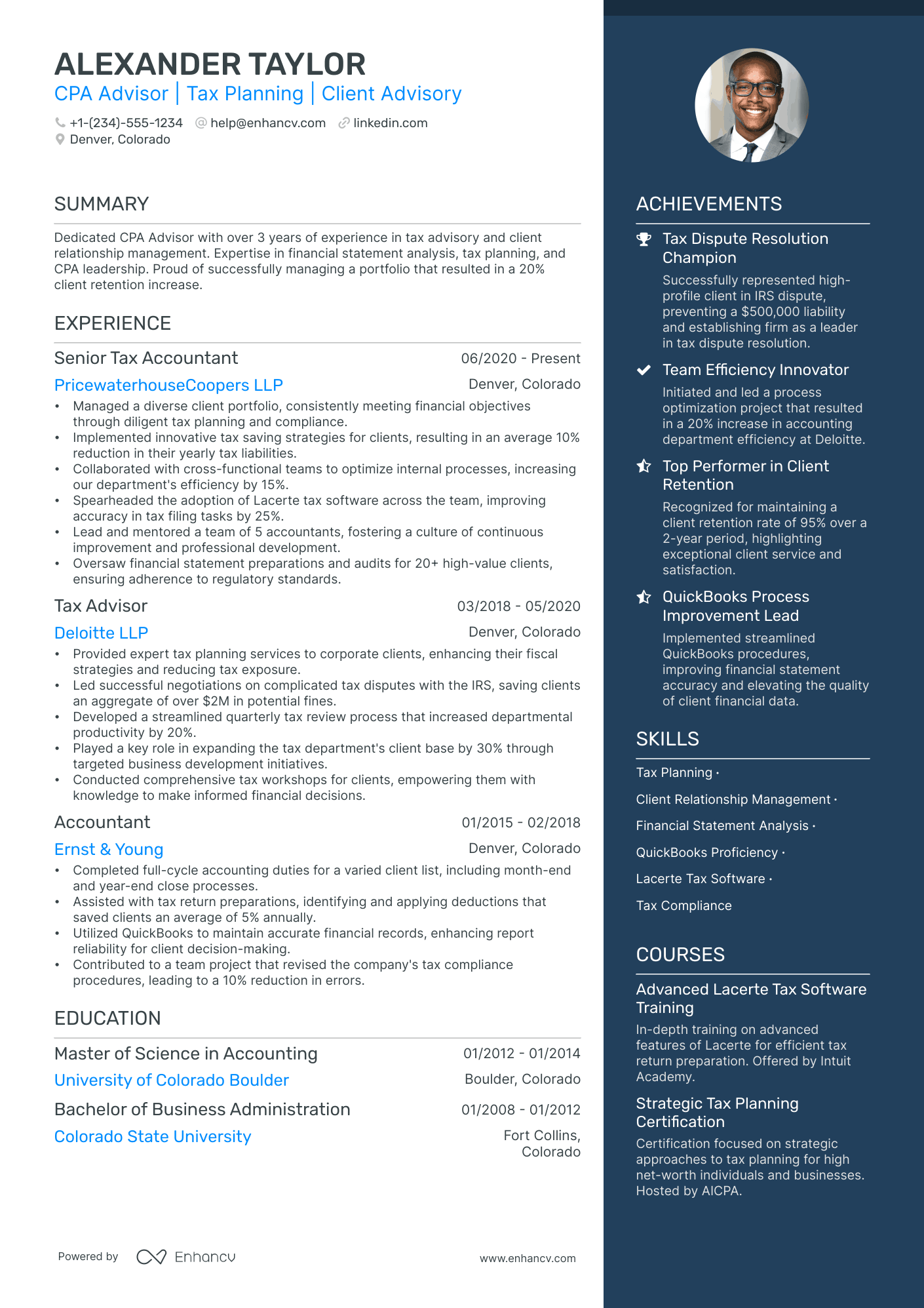

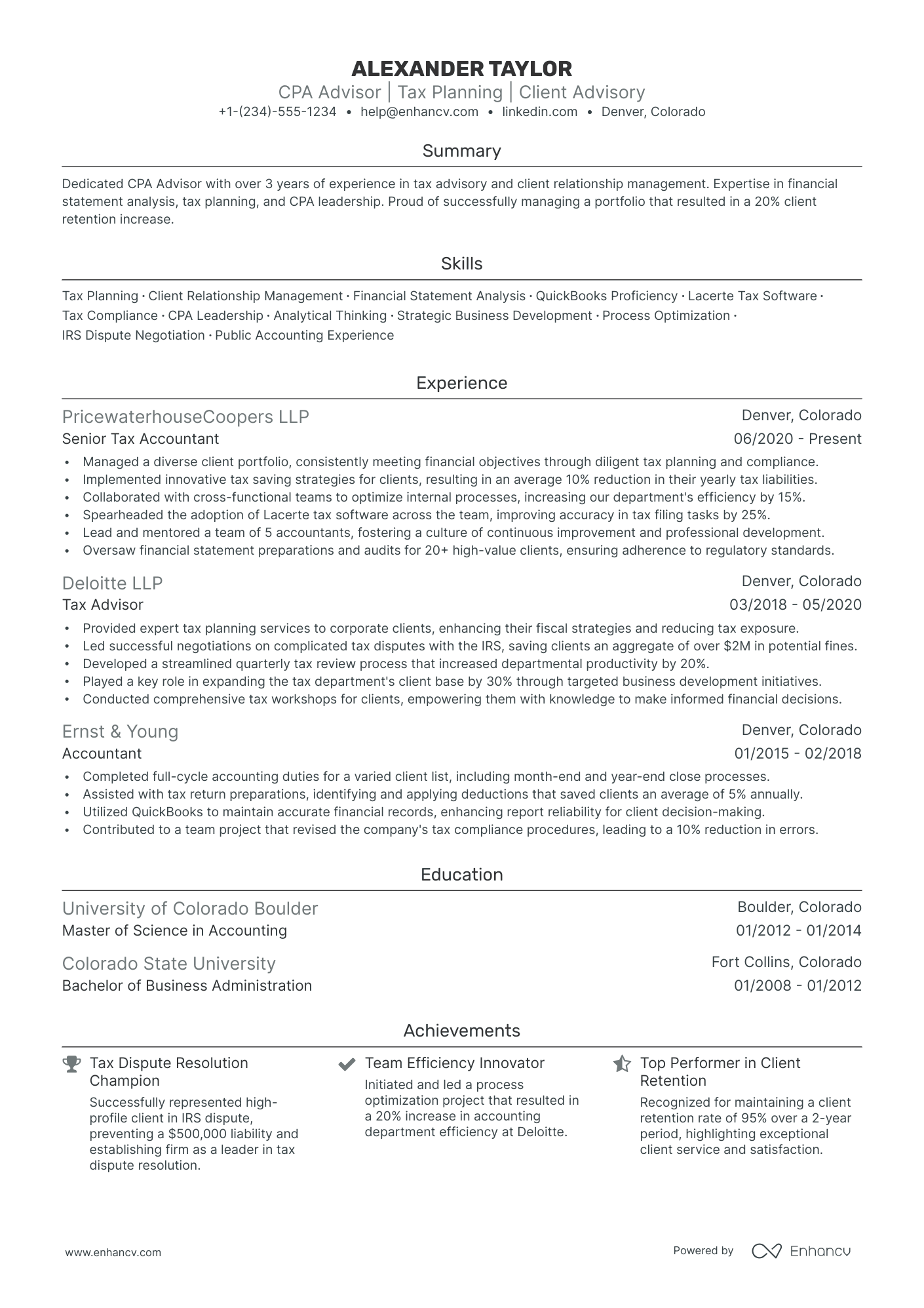

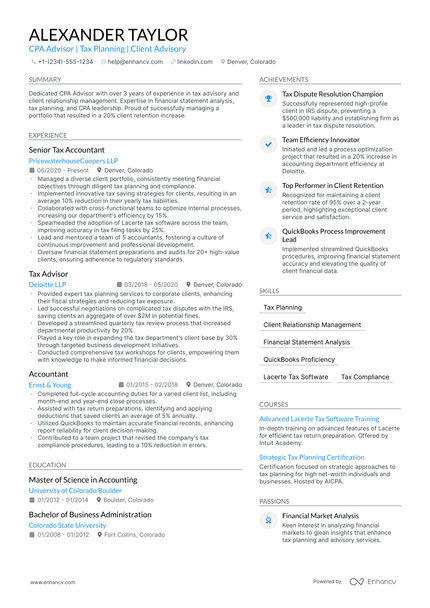

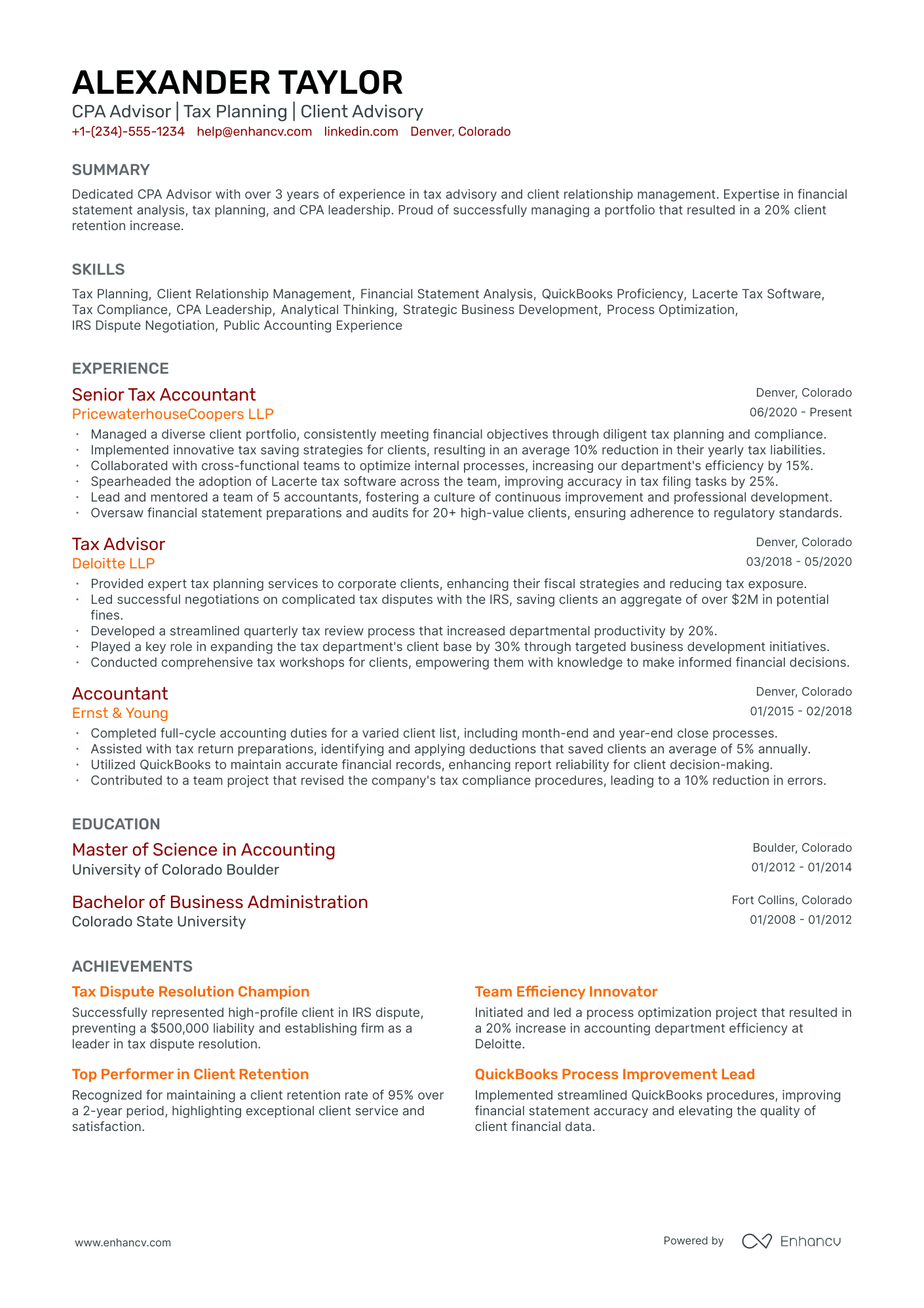

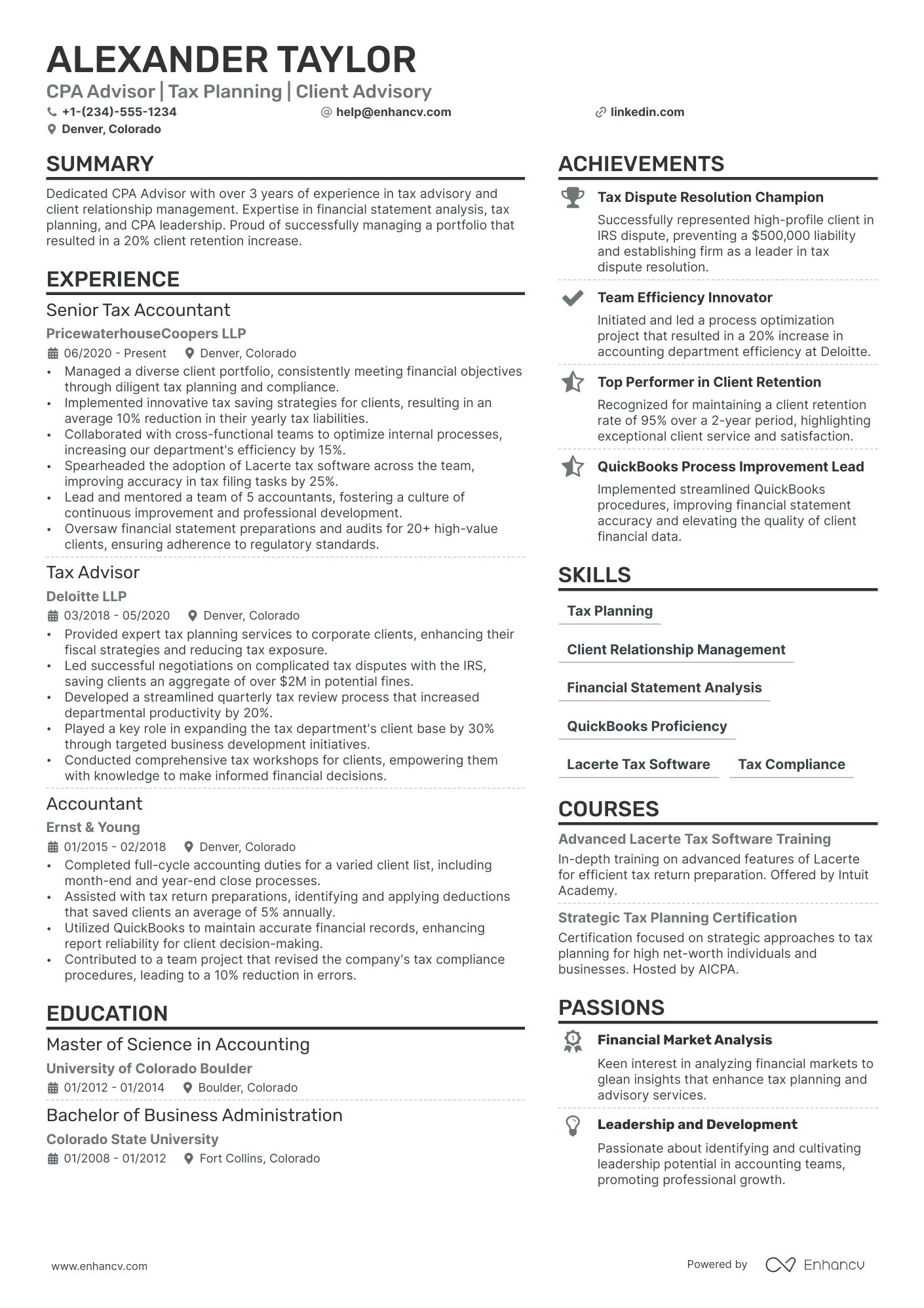

All Resume Templates Alexander Taylor CPA Advisor | Tax Planning | Client Advisory +1-(234)-555-1234 help@enhancv.com Denver, ColoradoDedicated CPA Advisor with over 3 years of experience in tax advisory and client relationship management. Expertise in financial statement analysis, tax planning, and CPA leadership. Proud of successfully managing a portfolio that resulted in a 20% client retention increase.

Experience Senior Tax Accountant PricewaterhouseCoopers LLP 06/2020 - Present Denver, ColoradoManaged a diverse client portfolio, consistently meeting financial objectives through diligent tax planning and compliance.

Implemented innovative tax saving strategies for clients, resulting in an average 10% reduction in their yearly tax liabilities.

Collaborated with cross-functional teams to optimize internal processes, increasing our department's efficiency by 15%.

Spearheaded the adoption of Lacerte tax software across the team, improving accuracy in tax filing tasks by 25%.

Lead and mentored a team of 5 accountants, fostering a culture of continuous improvement and professional development.

Oversaw financial statement preparations and audits for 20+ high-value clients, ensuring adherence to regulatory standards.

Tax Advisor Deloitte LLP 03/2018 - 05/2020 Denver, ColoradoProvided expert tax planning services to corporate clients, enhancing their fiscal strategies and reducing tax exposure.

Led successful negotiations on complicated tax disputes with the IRS, saving clients an aggregate of over $2M in potential fines.

Developed a streamlined quarterly tax review process that increased departmental productivity by 20%.

Played a key role in expanding the tax department's client base by 30% through targeted business development initiatives.

Conducted comprehensive tax workshops for clients, empowering them with knowledge to make informed financial decisions.

Accountant Ernst & Young 01/2015 - 02/2018 Denver, ColoradoCompleted full-cycle accounting duties for a varied client list, including month-end and year-end close processes.

Assisted with tax return preparations, identifying and applying deductions that saved clients an average of 5% annually.

Utilized QuickBooks to maintain accurate financial records, enhancing report reliability for client decision-making.

Contributed to a team project that revised the company's tax compliance procedures, leading to a 10% reduction in errors.

Master of Science in Accounting University of Colorado Boulder 01/2012 - 01/2014 Boulder, Colorado Bachelor of Business Administration Colorado State University 01/2008 - 01/2012 Fort Collins, Colorado Key Achievements Tax Dispute Resolution ChampionSuccessfully represented high-profile client in IRS dispute, preventing a $500,000 liability and establishing firm as a leader in tax dispute resolution.

Team Efficiency InnovatorInitiated and led a process optimization project that resulted in a 20% increase in accounting department efficiency at Deloitte.

Top Performer in Client RetentionRecognized for maintaining a client retention rate of 95% over a 2-year period, highlighting exceptional client service and satisfaction.

QuickBooks Process Improvement LeadImplemented streamlined QuickBooks procedures, improving financial statement accuracy and elevating the quality of client financial data.

Tax Planning Client Relationship Management Financial Statement Analysis QuickBooks Proficiency Lacerte Tax Software Tax Compliance Advanced Lacerte Tax Software TrainingIn-depth training on advanced features of Lacerte for efficient tax return preparation. Offered by Intuit Academy.

Strategic Tax Planning CertificationCertification focused on strategic approaches to tax planning for high net-worth individuals and businesses. Hosted by AICPA.

Financial Market AnalysisKeen interest in analyzing financial markets to glean insights that enhance tax planning and advisory services.

Leadership and DevelopmentPassionate about identifying and cultivating leadership potential in accounting teams, promoting professional growth.

www.enhancv.com Community Financial Literacy AdvocateDedicated to improving financial literacy by volunteering time to educate community members on basic tax and financial concepts.

www.enhancv.com

As a Certified Public Accountant (CPA), you may struggle to differentiate your resume in a market saturated with finance professionals. Our guide offers tailored strategies that can elevate your professional narrative, ensuring your unique expertise and accomplishments stand out to potential employers.

Drop your resume here or choose a file. PDF & DOCX only. Max 2MB file size.

Privacy guaranteedListing your relevant degrees or certificates on your cpa resume is a win-win situation. Not only does it hint at your technical capabilities in the industry, but an array of soft skills, like perseverance, adaptability, and motivation.

Have you ever wondered why recruiters care about your cpa expertise?

For starters, your past roles show that you've obtained the relevant on-the job training and expertise that'd be useful for the role.

To ensure your resume work experience section is as effective as possible, follow this formula:

The more details you can include - that are relevant to the job and linked with your skill set - the more likely you are to catch recruiters' attention.

Additionally, you can also scan the job advert for key requirements or buzzwords , which you can quantify across your experience section.

Not sure what we mean by this? Take inspiration from the cpa resume experience sections below:

Work Experience Senior CPA and Audit Manager 04/2017-OngoingManaged a portfolio of financial audits for mid-sized corporations, ensuring compliance with GAAP and reducing average audit completion times by 20%.

Streamlined tax planning processes for a diverse clientele, resulting in a 15% reduction in clients’ annual tax liabilities through strategic deferral and tax credit application.

Led a cross-departmental team to implement a new financial reporting software, improving reporting accuracy and reducing report generation times by 35%.

Work Experience Head of Corporate Finance Deloitte & Touche LLP 01/2015-12/2019Directed a financial team in restructuring the company's debt portfolio, saving the company an average of $2 million per annum in interest expenses.

Oversaw the successful external audit processes annually, with zero non-conformance issues reported over a five-year period.

Implemented a continuous financial monitoring system that increased the operational fund's efficiency by 25%, supporting strategic business expansion.

Work Experience International Tax CPA Ernst & Young 05/2012-08/2016Developed and executed a robust tax strategy for international operations, reducing the effective tax rate by 10% through the utilization of foreign tax credits.

Enhanced internal audit procedures by incorporating risk-based audit techniques, significantly improving the detection of fiscal discrepancies and vulnerabilities.

Trained and mentored a team of 15 junior accountants, raising the department's overall productivity and accuracy in financial reporting.

Work Experience CPA Financial Analyst PricewaterhouseCoopers 06/2009-09/2013Played a key role in advising on a high-profile merger worth $30 million, conducting due diligence and financial analysis that informed the successful negotiation strategy.

Executed a company-wide cost-reduction initiative by analyzing expenditure patterns, leading to a sustained 15% reduction in operational costs.

Collaborated with IT to co-develop a custom accounting software module to handle industry-specific financial transactions, increasing processing efficiency by 40%.

Work Experience Forensic CPA Specialist Grant Thornton LLP 03/2014-11/2018Provided expert witness testimony on financial matters in 20+ legal cases, which contributed to favorable outcomes in highly contested financial disputes.

Led the initiative to automate the accounts payable process, cutting down transaction processing time by 30% and reducing manual errors significantly.

Mastered the application of blockchain technology in accounting, enhancing data security and integrity across financial operations.

Work Experience Sustainability Financial CPA BDO USA, LLP 02/2010-08/2014Championed the adoption of a new financial modeling protocol which accurately projected fiscal outcomes and influenced the company's long-term strategic decisions.

Prepared detailed quarterly financial statements and reports for executive management that enhanced the decision-making process regarding new market ventures.

Integrated sustainable financial practices by advising on the adoption of green investments, leading to a recognized 5% improvement in corporate social responsibility ratings.

Work Experience Non-Profit Sector CPA Moss Adams LLP 11/2013-05/2017Performed comprehensive research and analysis to navigate complex tax legislation, resulting in the recapture of $500,000 in overpaid taxes for a number of clients.

Crafted and executed a strategic plan to manage a $25 million non-profit portfolio, achieving a consistent 8% return on investments annually.

Facilitated in-depth internal control assessments which identified key areas for improvement, subsequently enhancing operational efficiency by 20%.

Work Experience Corporate Restructuring CPA Crowe Horwath LLP 07/2011-02/2016Contributed to a vigorous restructuring of the company's payroll system, which supported a 10% increase in employee satisfaction relating to payroll accuracy and timeliness.

Identified and implemented cost-saving measures in procurement and supply chain management, leading to a reduction in costs of goods sold by 12%.

Assisted in the successful negotiation of a major vendor contract, securing favorable terms that saved the company $1.2 million over the duration of the contract.

Action or power verbs add depth to your experience. They also help you prove that you’ve taken charge of things in the past and are great at problem-solving and decision-making. Use them instead of buzzwords to make your cpa resume the center of attention!

You're quite set on the cpa role of your dreams and think your application may add further value to your potential employers. Yet, you have no work experience . Here's how you can curate your resume to substitute your lack of experience:

List your educational qualifications and certifications in reverse chronological order.

In any job advertisement, a blend of specific technologies and interpersonal communication skills is typically sought after. Hard skills represent your technical expertise and indicate your job performance capacity. Soft skills, on the other hand, demonstrate how well you would integrate within the company culture.

Incorporating a balanced mix of both skill types in your cpa resume is crucial. Here's how you can do it:

Accounting Software (e.g., QuickBooks, Sage)

Tax Preparation Software (e.g., TurboTax, H&R Block)

Audit Software (e.g., ACL, CaseWare)

ERP Systems (e.g., SAP, Oracle)

Data Analysis Tools (e.g., Tableau, Power BI)

Regulatory Compliance Tools

Accounting Standards (GAAP, IFRS)

SOFT SKILLSAttention to Detail

The more trusted the organization you've attained your certificate (or degree) from, the more credible your skill set would be.

In recent times, employers have started to favor more and more candidates who have the "right" skill alignment, instead of the "right" education.

But this doesn't mean that recruiters don't care about your certifications .

Dedicate some space on your resume to list degrees and certificates by:

If you happen to have a degree or certificate that is irrelevant to the job, you may leave it out.

Some of the most popular certificates for your resume include:

List your educational qualifications and certifications in reverse chronological order.

One of the most crucial elements of your professional presentation is your resume's top one-third. This most often includes:

If you want to go above and beyond with your cpa resume summary or resume objective, make sure to answer precisely why recruiters need to hire you. What is the additional value you'd provide to the company or organization? Now here are examples from real-life cpa professionals, whose resumes have helped them land their dream jobs:

Apart from the standard cpa resume sections listed in this guide, you have the opportunity to get creative with building your profile. Select additional resume sections that you deem align with the role, department, or company culture. Good choices for your cpa resume include:

Make sure that these sections don't take too much away from your experience, but instead build up your cpa professional profile.